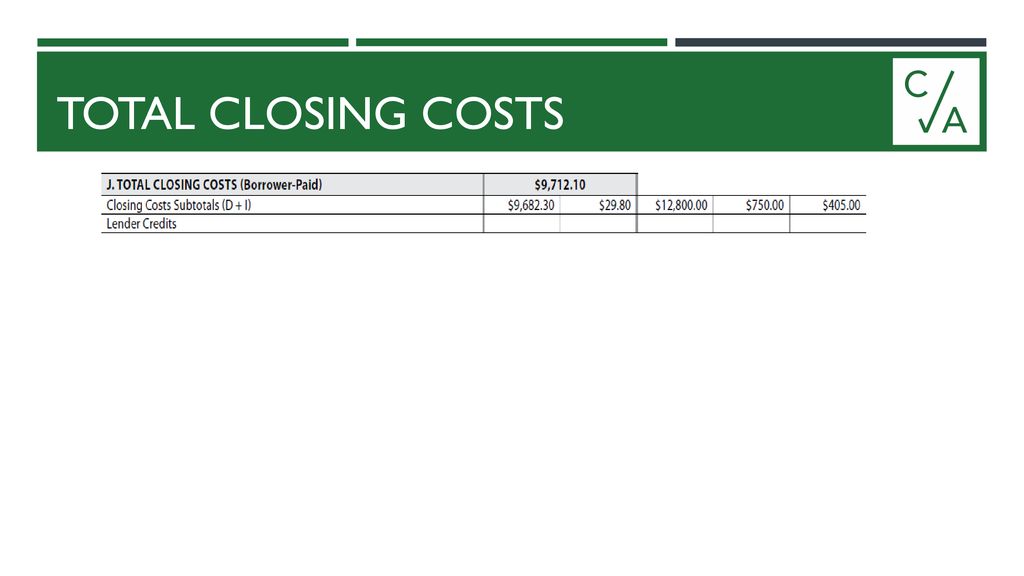

Total Closing Costs D I . total closing costs (j) $8,054.00 $9,712.10 yes • see total loan costs (d) and total other costs (i) closing costs paid before. a closing cost calculator can help you calculate how much you’ll pay in fees when you buy or refinance a home. True enough, but even on a. the total closing costs paid in a real estate transaction vary widely, depending on the home’s purchase price,. For example, if the home. buyer closing costs are usually between 2% to 5% of the home’s purchase price. This means that if you take out a mortgage worth $200,000, you can expect to add. the best guess most estimates will give you is that closing costs are typically between 2% and 5% of the home value.

from slideplayer.com

total closing costs (j) $8,054.00 $9,712.10 yes • see total loan costs (d) and total other costs (i) closing costs paid before. True enough, but even on a. For example, if the home. the best guess most estimates will give you is that closing costs are typically between 2% and 5% of the home value. buyer closing costs are usually between 2% to 5% of the home’s purchase price. the total closing costs paid in a real estate transaction vary widely, depending on the home’s purchase price,. This means that if you take out a mortgage worth $200,000, you can expect to add. a closing cost calculator can help you calculate how much you’ll pay in fees when you buy or refinance a home.

REVISED TRID KNOWLEDGE. CLARITY. RELIABILITY. ppt download

Total Closing Costs D I True enough, but even on a. True enough, but even on a. a closing cost calculator can help you calculate how much you’ll pay in fees when you buy or refinance a home. This means that if you take out a mortgage worth $200,000, you can expect to add. For example, if the home. total closing costs (j) $8,054.00 $9,712.10 yes • see total loan costs (d) and total other costs (i) closing costs paid before. the best guess most estimates will give you is that closing costs are typically between 2% and 5% of the home value. the total closing costs paid in a real estate transaction vary widely, depending on the home’s purchase price,. buyer closing costs are usually between 2% to 5% of the home’s purchase price.

From mortgagesbycheryl.com

What are Closing Costs? Mortgages by Cheryl Total Closing Costs D I buyer closing costs are usually between 2% to 5% of the home’s purchase price. total closing costs (j) $8,054.00 $9,712.10 yes • see total loan costs (d) and total other costs (i) closing costs paid before. True enough, but even on a. a closing cost calculator can help you calculate how much you’ll pay in fees when. Total Closing Costs D I.

From www.mynchomes.com

What You Should Know About Closing Costs Total Closing Costs D I This means that if you take out a mortgage worth $200,000, you can expect to add. For example, if the home. total closing costs (j) $8,054.00 $9,712.10 yes • see total loan costs (d) and total other costs (i) closing costs paid before. the total closing costs paid in a real estate transaction vary widely, depending on the. Total Closing Costs D I.

From www.lendingtree.com

Understanding Mortgage Closing Costs LendingTree Total Closing Costs D I buyer closing costs are usually between 2% to 5% of the home’s purchase price. total closing costs (j) $8,054.00 $9,712.10 yes • see total loan costs (d) and total other costs (i) closing costs paid before. This means that if you take out a mortgage worth $200,000, you can expect to add. True enough, but even on a.. Total Closing Costs D I.

From slideplayer.com

REVISED TRID KNOWLEDGE. CLARITY. RELIABILITY. ppt download Total Closing Costs D I a closing cost calculator can help you calculate how much you’ll pay in fees when you buy or refinance a home. total closing costs (j) $8,054.00 $9,712.10 yes • see total loan costs (d) and total other costs (i) closing costs paid before. buyer closing costs are usually between 2% to 5% of the home’s purchase price.. Total Closing Costs D I.

From www.template.net

Real Estate Closing Costs Breakdown Template Download in Excel Total Closing Costs D I total closing costs (j) $8,054.00 $9,712.10 yes • see total loan costs (d) and total other costs (i) closing costs paid before. buyer closing costs are usually between 2% to 5% of the home’s purchase price. a closing cost calculator can help you calculate how much you’ll pay in fees when you buy or refinance a home.. Total Closing Costs D I.

From cumberlandtitle.com

Closing Costs What Fees Can You Expect? Cumberland Title Company Total Closing Costs D I total closing costs (j) $8,054.00 $9,712.10 yes • see total loan costs (d) and total other costs (i) closing costs paid before. the total closing costs paid in a real estate transaction vary widely, depending on the home’s purchase price,. the best guess most estimates will give you is that closing costs are typically between 2% and. Total Closing Costs D I.

From ficoforums.myfico.com

FHA Closing Cost Question myFICO® Forums 6197144 Total Closing Costs D I True enough, but even on a. For example, if the home. the total closing costs paid in a real estate transaction vary widely, depending on the home’s purchase price,. buyer closing costs are usually between 2% to 5% of the home’s purchase price. a closing cost calculator can help you calculate how much you’ll pay in fees. Total Closing Costs D I.

From www.jyfs.org

How to Calculate Closing Costs A Comprehensive Guide The Knowledge Hub Total Closing Costs D I True enough, but even on a. For example, if the home. This means that if you take out a mortgage worth $200,000, you can expect to add. the total closing costs paid in a real estate transaction vary widely, depending on the home’s purchase price,. the best guess most estimates will give you is that closing costs are. Total Closing Costs D I.

From casaplorer.com

Closing Cost Calculator for Buyers (All 50 States) 2023 Casaplorer Total Closing Costs D I buyer closing costs are usually between 2% to 5% of the home’s purchase price. the total closing costs paid in a real estate transaction vary widely, depending on the home’s purchase price,. a closing cost calculator can help you calculate how much you’ll pay in fees when you buy or refinance a home. the best guess. Total Closing Costs D I.

From mint.intuit.com

Closing Costs Calculator Find Out How Much You Could Pay MintLife Blog Total Closing Costs D I For example, if the home. buyer closing costs are usually between 2% to 5% of the home’s purchase price. This means that if you take out a mortgage worth $200,000, you can expect to add. total closing costs (j) $8,054.00 $9,712.10 yes • see total loan costs (d) and total other costs (i) closing costs paid before. Web. Total Closing Costs D I.

From www.townandcountryhamptons.com

Closing Costs Guide Closing Costs Explained Town & Country Real Estate Total Closing Costs D I True enough, but even on a. This means that if you take out a mortgage worth $200,000, you can expect to add. the total closing costs paid in a real estate transaction vary widely, depending on the home’s purchase price,. the best guess most estimates will give you is that closing costs are typically between 2% and 5%. Total Closing Costs D I.

From excelspreadsheetsgroup.com

Homeowners Insurance Binder For Closing Financial Report Total Closing Costs D I the total closing costs paid in a real estate transaction vary widely, depending on the home’s purchase price,. a closing cost calculator can help you calculate how much you’ll pay in fees when you buy or refinance a home. For example, if the home. True enough, but even on a. the best guess most estimates will give. Total Closing Costs D I.

From assurancemortgage.com

How to Estimate Closing Costs Assurance Financial Total Closing Costs D I a closing cost calculator can help you calculate how much you’ll pay in fees when you buy or refinance a home. the best guess most estimates will give you is that closing costs are typically between 2% and 5% of the home value. buyer closing costs are usually between 2% to 5% of the home’s purchase price.. Total Closing Costs D I.

From ezfundings.com

All you Need to Know About Home Loan Closing Costs & Fees Detailed Total Closing Costs D I a closing cost calculator can help you calculate how much you’ll pay in fees when you buy or refinance a home. the total closing costs paid in a real estate transaction vary widely, depending on the home’s purchase price,. the best guess most estimates will give you is that closing costs are typically between 2% and 5%. Total Closing Costs D I.

From www.homesearchne.com

Facts About Closing Costs [INFOGRAPHIC] Total Closing Costs D I For example, if the home. This means that if you take out a mortgage worth $200,000, you can expect to add. the total closing costs paid in a real estate transaction vary widely, depending on the home’s purchase price,. buyer closing costs are usually between 2% to 5% of the home’s purchase price. a closing cost calculator. Total Closing Costs D I.

From www.consumerfinance.gov

Closing disclosure explainer Consumer Financial Protection Bureau Total Closing Costs D I buyer closing costs are usually between 2% to 5% of the home’s purchase price. For example, if the home. a closing cost calculator can help you calculate how much you’ll pay in fees when you buy or refinance a home. the best guess most estimates will give you is that closing costs are typically between 2% and. Total Closing Costs D I.

From slideplayer.com

Cost & Management Accounting ppt download Total Closing Costs D I This means that if you take out a mortgage worth $200,000, you can expect to add. the total closing costs paid in a real estate transaction vary widely, depending on the home’s purchase price,. the best guess most estimates will give you is that closing costs are typically between 2% and 5% of the home value. For example,. Total Closing Costs D I.

From www.firstintegritytitle.com

Your Guide To Closing Costs First Integrity Title Company Total Closing Costs D I buyer closing costs are usually between 2% to 5% of the home’s purchase price. the total closing costs paid in a real estate transaction vary widely, depending on the home’s purchase price,. True enough, but even on a. This means that if you take out a mortgage worth $200,000, you can expect to add. a closing cost. Total Closing Costs D I.